As the fallout from the coronavirus pandemic reshapes the world, few sectors have been as hard hit as the mobility industry. With citizens locked indoors across the globe, demand for mobility, transport, and travel has plummeted. Combined with an economic contraction, 2020 is shaping up to be a bleak year for mobility operators of all sorts and sizes.

With that in mind, on April 1st, CoMotion registered hundreds of mobility experts to join with top VCs for a special edition of CoMotion LIVE (replay available here), focused on what the current climate means for mobility operators, and how savvy companies can still prosper.

As the community weighed in, a few trends emerged, revealing a more complicated picture than the grim headlines suggest.

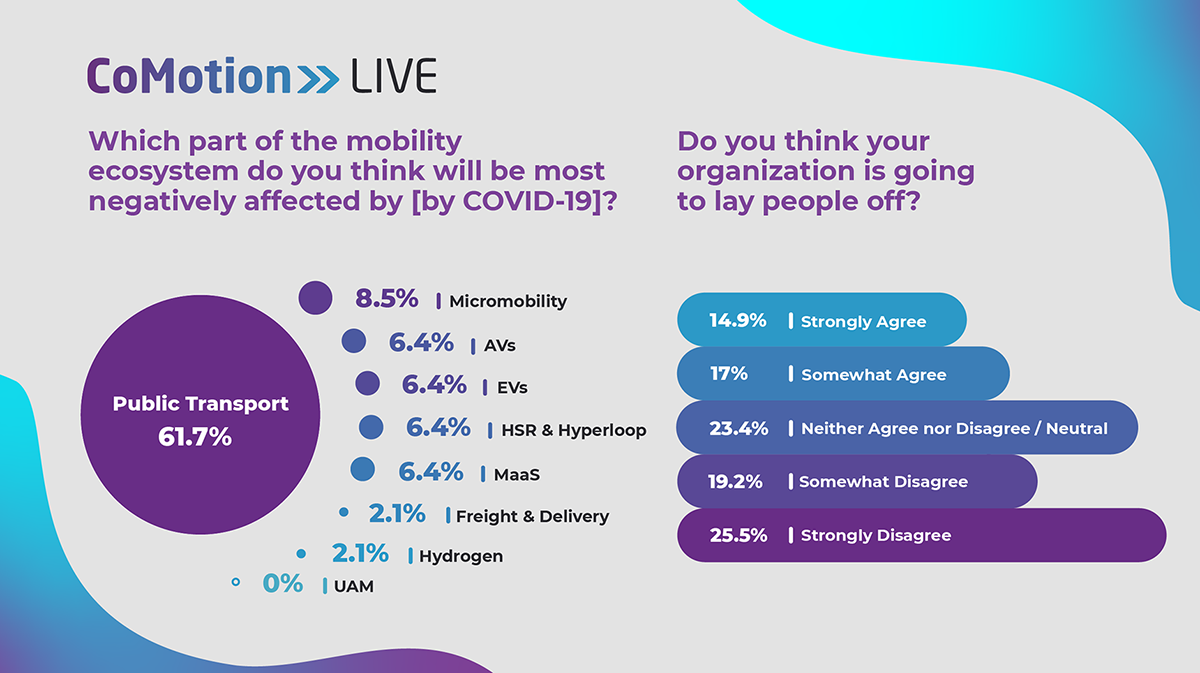

When polled about “which part of the mobility ecosystem do you think will be most negatively affected?” the mobility community unsurprisingly rated public transport and micromobility to be most affected. Given reports of transit ridership cratering up to 90% in major cities, and micromobility operators like Bird and Lime pulling their fleets from the streets, that makes sense. Unexpectedly, however, the community thought the UAM (urban aerial mobility) sector would be the least impacted. Given the industry’s capital intensity, and longer roadmap to commercial deployment, that’s a somewhat surprising result.

When queried “do you think your organization is going to lay people off?” the results were also not as dire as one might predict. While many respondents do fear their firm’s head count will fall, the vast majority did not think that their organization was going to cut personnel.

Gazing at their crystal balls, the mobility community was then asked how long they thought the economic contraction would last. While few think it will be as brief as a month, most also did not fear a recession lasting a half year or greater. The plurality of respondents, 46.8%, predicted a three to six month contraction period.

When the conversation turned to fundraising, a near majority, 48.9%, responded that their company was actively fundraising. While that may sound like a tricky position to be in given the current situation, all of the venture capitalists speaking on the webinar reported that their firms were still sourcing deals and cutting checks.

Given the circumstances, mobility VCs were cautiously optimistic. Their firms are still investing, and they by and large thought the current moment would serve as a cooling off period, taming a market that had gotten overly frothy. While weaker ideas and less capitalized firms might not all make it through the current crisis, the mobility sector may end up emerging healthier in the long term.

Want to learn more about how Coronavirus is affecting the world around us, and how smart mobility operators are responding? Register for our upcoming CoMotion LIVE webinar “How Public Transit Bounces Back” — taking place Apr 14, 2020 at 12:00 PM ET.