With a Focus on Latin America, Cabify Beats Uber & Lyft in the Race to Ridesharing Profits

In the hyper competitive world of ridesharing, the major TNC players are famous for two things: trouble with regulators, and miles of red ink. While Uber and Lyft may be constantly duking it out with local governments, and consequently rapidly entering and exiting markets around the world, a smaller competitor – Cabify – has mostly flown under the radar.

Founded in Madrid in 2011, Cabify quickly pivoted to make Latin America the focus of its operations. Instead of trying to conquer ancillary markets like food delivery and autonomy, the Spanish company has had a near singular focus on one thing above all else: profitability.

Last quarter, that dedication finally paid off; the company reported $29 million in revenue in the final quarter of 2019, and an EBITDA of $3 million. While those numbers aren’t huge, they’re big enough to make Cabify the very first ridesharing operator to actually reach profitability. “Our positive EBITDA reinforces our independence by allowing us to increase our long-term impact and, without a doubt, makes a difference with the rest of the great competitors,” said Cabify founder and CEO, Juan de Antonio.

What’s The Secret?

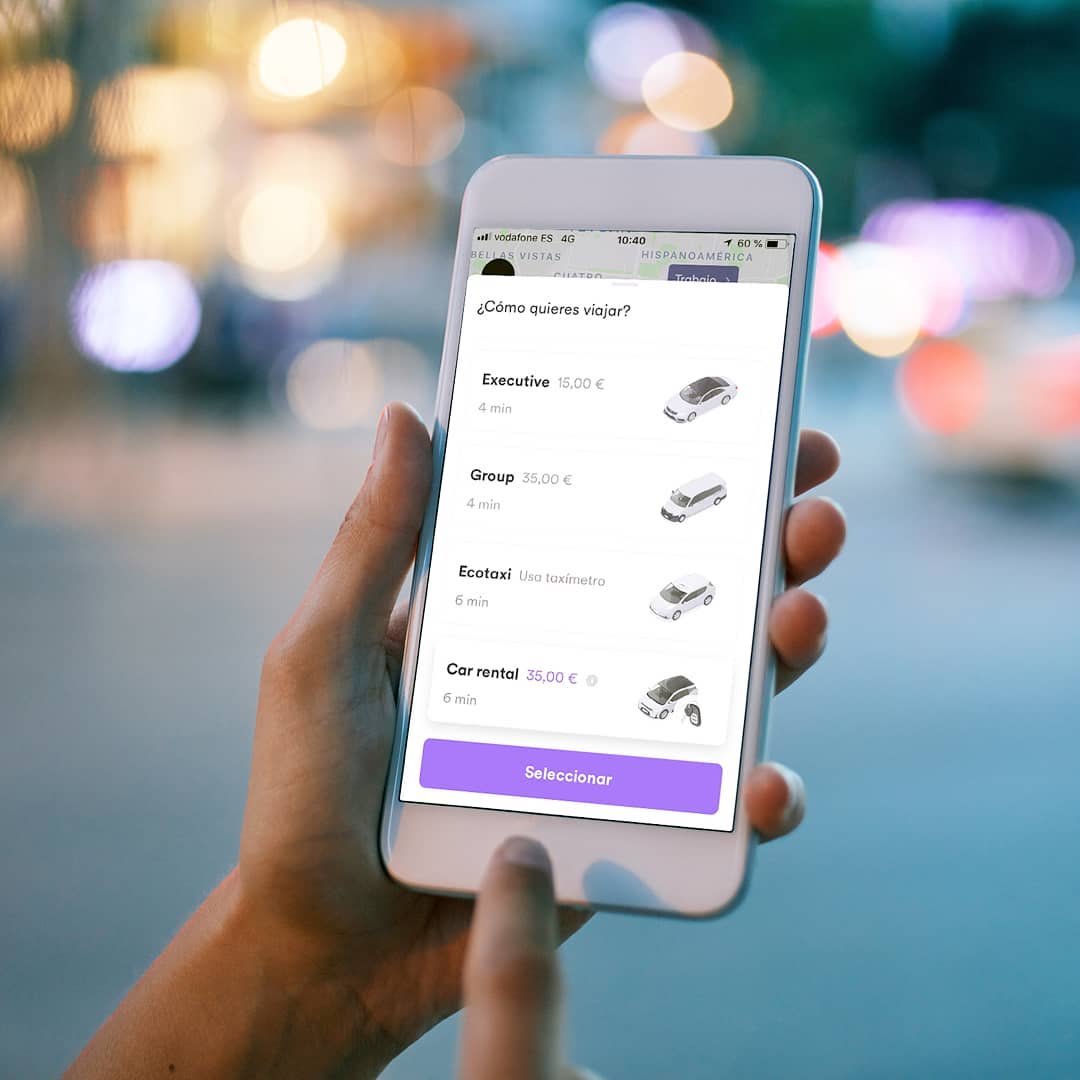

Cabify operates a bit differently than the likes of Uber or Lyft; everything starts with its rigorous selection and filtering process used to vet drivers. All drivers must pass psychometric tests, drug and alcohol screenings, and a city orientation test, and in most cases possess a commercial driving permit. The idea is to build the brand around security, transparency, and quality service. With over 33 million registered users across the globe and 200,000+ drivers, that’s a lot of people to keep happy and safe. The biggest difference, however, is in its pricing structure: unlike Uber, which charges for the time and distance travelled during a trip, Cabify charges a fixed price per kilometer.

“We see ourselves as a Latin company that’s founded in Spain. Latin America has a lot of potential in spite of instability in the region. We do believe that in the medium and long term, Latin America is going to grow.”

Even more significantly, Cabify stands out thanks to its focus on Latin American markets. Besides its homebase in Spain, the TNC currently operates in Argentina, Brazil, Chile, Colombia, Dominican Republic, Ecuador, Mexico, Panama, Peru, and Uruguay.

A Fortuitous Latin American Expansion

A little more than a year after Juan de Antonio founded the company in May 2011, Cabify entered its first Latin American market: Lima, Peru, on October 17, 2012. From there, the company quickly expanded operations to Mexico, Chile, and Peru. Within only a few years, a majority of Cabify’s proceeds was coming from Latin America. In fact, by 2017, Latin America represented a whopping 83% of Cabify’s revenue.

The key to Cabify’s big LatAm push was a well timed cash infusion, as Japanese e-commerce giant Rakuten invested $92 million in October 2015. At the time, Cabify’s head of growth for Latin America, Ricardo Weder, said: “We see ourselves as a Latin company that’s founded in Spain. Latin America has a lot of potential in spite of instability in the region. We do believe that in the medium and long term, Latin America is going to grow.”

Through its highly strategic deployments, Cabify has been able to enter markets even when competitors already have a foothold. With the likes of Didi Chuxing owned 99, Uber, Beat, and more all vying for the same business, Cabify has found the trick to standing out from the crowd is the efficient use of discounts and extreme pricing discipline. Cabify isn’t interested in suffering the heavy losses that come from aggressive couponing, which has become standard for competitors fighting over market share in saturated markets. According to Jorge Pilo, Cabify’s country manager for Brazil, their secret sauce is a mix of building brand awareness and focusing on retaining customers through a high standard of quality. Pilo said, “We will have discounts on our strategy, but we need to strike a balance and do it in a rational way. We will not subsidize rides with high discounts on a recurring basis and compromise the financial sustainability of the business.”

A Cabify user explores their many mobility options.

Data Deep Dives and the MaaS Method

Another big focus of the company is continuous improvements to its underlying technology. Algorithm upgrades have produced better matching of drivers and passengers, reduced customer wait times, and improved incident detection and response. Pilo said, “We use technology and automation to analyze passenger and driver behavior indicators in a scalable manner. This enables problem-solving before users even realize, therefore improving their experience while increasing operational efficiency.”

Cabify’s ultimate goal is to become a fully integrated Mobility-as-a-Service app. After merging with Brazil’s Easy Taxi, the two companies initially operated as separate units. As Cabify pushed further into becoming a broader MaaS platform, it integrated taxi hailing into its app. Now, users in Brazil, Colombia, Chile, Ecuador, Mexico, Peru, and Uruguay can choose between hiring a private Cabify driver or a traditional taxi. This move not only allows their customers a greater range of options, it also protects Cabify from any potential regulatory issues that might crop up with its ridesharing fleet. Should a city or country require freelance Cabify drivers to cease operations, Cabify riders won’t be left twisting in the wind.

Cabify clearly has big growth ambitions; along with standard ridesharing, the company has expanded into executive livery service, taxis, scooters, and electric motorcycles, making it effectively a one-stop shop for all things transportation. Given Latin America’s high urbanization rate and continued population growth, it looks like Cabify may have found the road to riches.

Interested in learning more about the fast-moving world of Latin American mobility? Join us at CoMotion MIAMI, where we’ll be gathering the brightest minds and savviest companies from across Latin America, Florida, and the world at large. The festivities kick off in the Wynwood Art District this June 25th & 26th.

Header image courtesy Cabify